#Basic mortgage loan calc how to#

Keep Reading: How to Find the Best Mortgage Lender Compare rates Get your financial documents organized, too. Lenders usually like to see at least two years of employment history. A low DTI ratio indicates you have ample cash to afford your new monthly mortgage payment. Down payment requirements vary by loan type, but generally, bigger down payments will make it easier to qualify for a mortgage. This will help you get the best mortgage rate, too. Settle any late or overdue payments, pay down some debts, and report any errors on your credit report. To ensure you have the best shot at qualifying for a loan, you should: The right decision depends on your budget and what you can manage financially, given your income and existing debts.įind Out: How to Know If You Should Buy a House How to qualify for a mortgage The 15-year loan will mean less in interest, though you’ll have a higher monthly payment.The 30-year term will come with a lower monthly payment, but you’ll pay more in interest over time.Just enter your expected home price and interest rate, and see what the costs come to for both a 15-year and a 30-year term. The loan payment calculator can also help you determine your loan terms. $1,000 is 20% of $5,000 Should I take out a 15-year or 30-year fixed mortgage? Learn More: How Your Credit Score Impacts Mortgage RatesĬredible allows you to compare all of our partner lenders in the table below at once, all by filling out just one simple form.įor example: If your total debt includes $600 a month in student loans and a monthly car payment of $400, and your income is $5,000 every month, your DTI would be 20%. You can also apply for rate quotes from several different lenders below. If you’re not sure what to put in for the interest rate on the calculator, scroll down and see what mortgage rates you can expect in today’s market.

#Basic mortgage loan calc full#

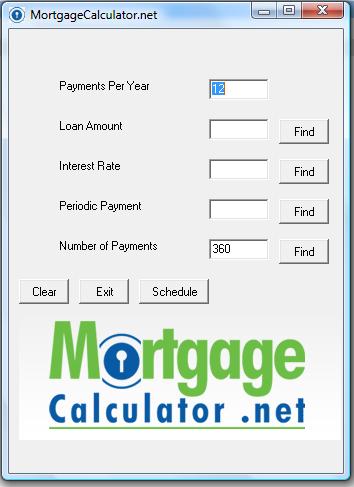

For a full look at how much you’ll pay every year, you’ll want a mortgage amortization schedule. Enter the details of your mortgage loan, and you’ll see both your total payments and the total interest you’ll pay over time. If you want to know how much it costs to buy a house, the calculator can help. Enter in both loan details, and see which one has the payment and total costs to fit your needs. a 30-year home loan), you can also use the calculator to help. If you’re considering loans from different lenders (or a 15-year vs. Enter a few different loan amounts until you see a monthly payment you can afford. You can also use the calculator to determine your budget. Is it within budget? If it is, you might have just found that dream home. Add in your estimated interest rate and loan term, and you’ll see your estimated monthly payment. If you find a house you like, enter in the loan amount you’d need to buy it (the home’s price minus your down payment).

It can help you calculate your estimated monthly payment, set your homebuying budget, and more. There are many use cases for a mortgage loan payments calculator. How to use our mortgage loan payments calculator

0 kommentar(er)

0 kommentar(er)